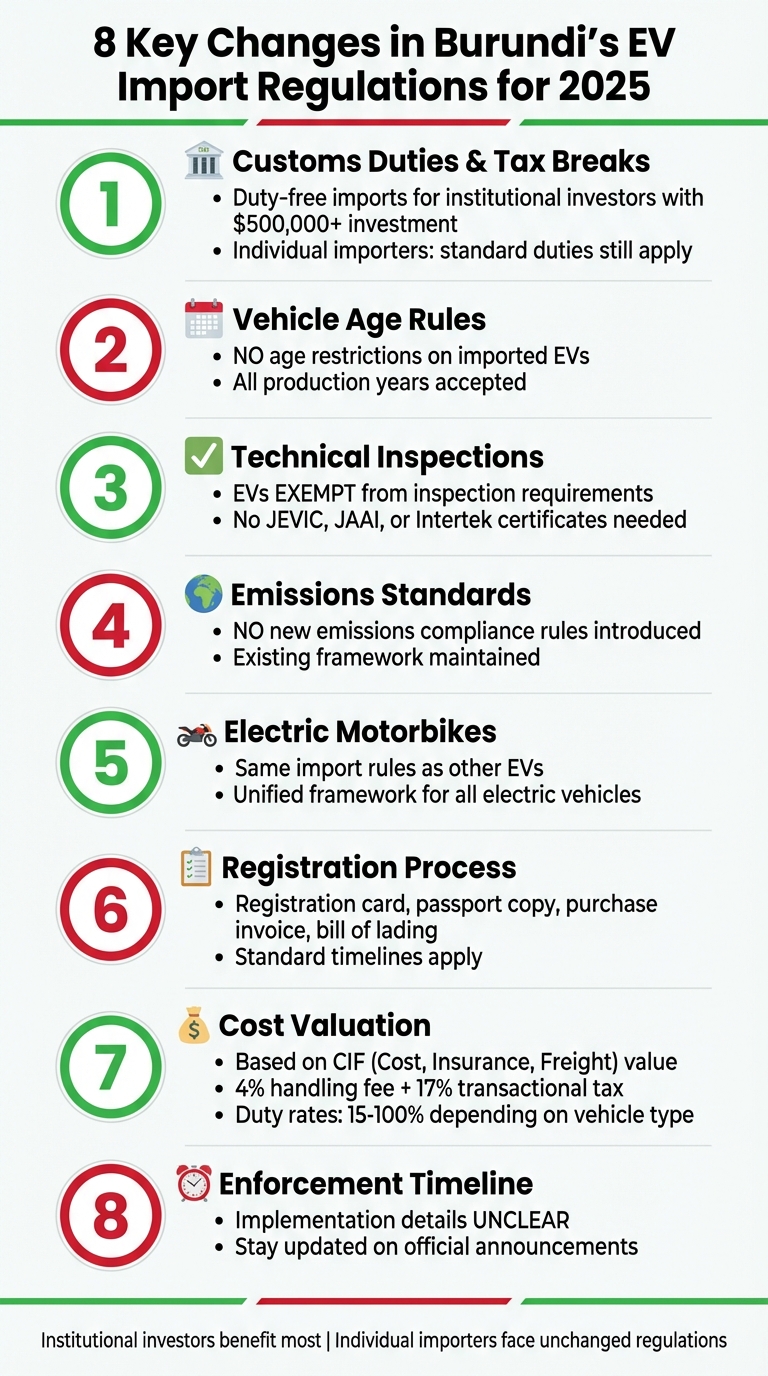

Burundi has introduced eight changes to its electric vehicle (EV) import regulations for 2025, aiming to support EV adoption while balancing costs and accessibility. Here’s a quick summary of the updates:

- Customs Duties & Tax Breaks: Institutional investors meeting a $500,000 investment threshold can import EVs duty-free under specific conditions. Individual importers, however, will still face standard duties.

- Vehicle Age Rules: No restrictions on the age of imported EVs, unlike neighboring countries that limit older vehicles.

- Technical Inspections: Imported EVs remain exempt from inspection requirements, simplifying the process.

- Emissions Standards: No new emissions compliance rules have been introduced for EV imports.

- Electric Motorbikes: Motorbikes and light EVs follow the same import rules as other EVs, streamlining procedures.

- Registration Process: Standard documentation is required for registration, including a registration card, purchase invoice, and bill of lading.

- Cost Valuation: Import costs are based on the CIF (Cost, Insurance, Freight) value, with duties and taxes applied accordingly.

- Enforcement Timeline: Implementation details remain unclear, requiring importers to stay updated on any announcements.

These updates aim to make EV imports more accessible while maintaining straightforward processes for businesses and consumers. However, institutional investors benefit most from the new incentives, while individual importers face unchanged regulations. Staying informed and prepared is key to navigating these changes effectively.

Burundi’s 8 Key EV Import Regulation Changes for 2025

1. Changes to Customs Duties and Tax Breaks for EVs

Burundi is making adjustments to its customs duties to better align with global practices for electric vehicle (EV) imports. Currently, the country’s customs duty rates for vehicle imports range from 1% to 100% of the CIF (Cost, Insurance, and Freight) value. For example, standard passenger vehicles are subject to a 4% handling charge and a 17% tax, while tourism vehicles face much steeper charges. These existing structures serve as the foundation for the new exemptions introduced in the updated regulations.

Under the upcoming 2025 regulatory changes, customs duties won’t be universally reduced for all EV imports. Instead, these adjustments build on Burundi’s Investment Law No. 1/19, enacted on June 17, 2021. This law provides customs duty exemptions for certified investors operating in priority sectors like transport. To qualify, foreign investors must meet specific conditions: they need to invest at least $500,000 at Bujumbura City Hall and undertake approved projects – such as new developments, expansions, renovations, or modernization efforts – while adhering to environmental and labor laws. Although VAT collection remains mandatory, approved investors can import essential capital goods duty-free for five to ten years, provided these goods are not available locally in adequate quantity or quality.

However, these benefits are limited to institutional investors who meet the $500,000 investment threshold and engage in qualifying projects. Individual EV importers are excluded from these exemptions. For standard EV imports that fall outside this framework, the current customs duties applied to conventional vehicles will remain unchanged.

2. Age and Condition Restrictions for Imported EVs

Burundi stands out by not imposing any age restrictions on the import of used electric vehicles – a policy that will remain in place even with the 2025 regulatory updates. This means importers can bring in EVs regardless of their production year.

In contrast, neighboring countries like Nigeria and Kenya limit imports to vehicles that are less than 8 years old, while Ghana outright bans vehicles older than 10 years. By allowing older models, Burundi offers a broader range of options, including more affordable choices for buyers.

Another unique aspect of Burundi’s policy is the exemption of imported EVs from mandatory inspections, which are standard in many other markets. This not only cuts down on inspection fees but also lowers potential repair costs, making the import process simpler and more economical.

This open approach to regulations makes EVs more accessible and affordable in Burundi, helping to encourage the transition to electric mobility. Upcoming updates to technical inspection and certification rules will further enhance the import process.

3. New Technical Inspection and Certification Rules

Burundi has decided to extend its no-inspection policy for imported electric vehicles (EVs) through 2025. This means EVs entering the country are not required to have technical inspection certificates from organizations like JEVIC, JAAI, or Intertek. By removing this step, the import process becomes much simpler for EV buyers.

For instance, if you’re importing a used EV from Japan, the process only requires a few key documents: the Original Registration Card, a copy of your passport, the Original Purchase Invoice, and the Original Bill of Lading. The Bill of Lading should include essential vehicle details like the chassis number, engine number, and year of manufacture.

However, the quality of used vehicles being imported into Africa has been a topic of concern. An October 2020 report by the UN Environment Programme highlighted that many used cars sent to low and middle-income countries "are of poor quality and would fail roadworthiness tests in the exporting countries". Despite these warnings, Burundi has chosen to stick with its inspection-free policy. To further promote EV adoption, the government is also offering subsidies, focusing on making EVs more accessible and affordable for its citizens.

4. Environmental and Emissions Compliance Standards

Burundi has chosen to stick with its existing environmental compliance framework for imported electric vehicles (EVs). This means there are no new emissions standards or certification requirements for EV importers, allowing them to continue operations without the need for additional documentation. Meanwhile, many other nations around the world are tightening their environmental regulations.

A report from the UN Environment Programme, published in October 2020, raised concerns about the global trade of used vehicles. It stated that "Millions of used cars, vans and minibuses exported from Europe, the US and Japan to low and middle-income countries are hindering efforts to combat climate change" and pointed out that these vehicles "are contributing to air pollution and are often involved in road accidents". The report also noted that Africa receives 40% of the world’s used light-duty vehicle exports. On a global scale, at least 17 countries have already set target dates to phase out internal combustion engine vehicles.

5. Import Rules for Electric Motorbikes and Light EVs

Burundi has established a streamlined import framework for all electric vehicles, including light electric vehicles like motorbikes and scooters. These vehicles are subject to the same customs procedures, tax rates, age limits, and technical standards as other electric vehicles. This unified approach simplifies the import process for businesses and ensures uniformity across different types of electric vehicles.

sbb-itb-99e19e3

6. EV Registration, Number Plates, and Logbook Procedures

The 2025 guidelines stick to the usual registration process for imported EVs. This involves clearing customs first, followed by registering the vehicle to get its number plates and logbook.

To complete the registration, you’ll need these original documents:

- Original Registration Card from the vehicle’s country of origin

- A copy of your passport

- Original Purchase Invoice

- Original Bill of Lading that includes details like the chassis number, engine number, cubic capacity, year of manufacture, brand, and model

Once you submit these documents, the registration fees will be calculated according to the standard procedure. Keep in mind, there are extra charges, including handling and transactional fees, which are based on the vehicle’s CIF (Cost, Insurance, and Freight) value.

The process follows the usual timelines, with no option for faster processing. The logbook you’ll receive serves as the official proof of ownership and needs to be updated whenever there are changes.

7. Financing, Valuation, and Customs Clearance Updates

The 2025 regulations stick to the cost valuation framework based on the CIF (Cost, Insurance, and Freight) value, keeping budgeting straightforward and predictable.

Duty rates depend on the type of vehicle being imported. For example, EVs built to carry more than 10 passengers are subject to a 15% duty on their CIF value. Tourism vehicles, on the other hand, face duties ranging from 40% to 100%. On top of that, there’s a 4% handling fee, and a 17% transactional tax applies to the combined total of the CIF value, duties, and handling charges. Here’s a quick example: if you’re importing an EV valued at $20,000 with a 40% duty rate, you’d pay $8,000 in duties, a $800 handling fee, and a 17% tax on the subtotal. This brings the total cost to $33,696.

Once duty calculations are sorted, the customs clearance process remains smooth. No additional inspection requirements have been introduced, keeping things efficient.

For transportation, since Burundi is a landlocked country, your EV will likely arrive through the Dar Es Salaam port in Tanzania or the Mombasa port in Kenya. You can choose containerized shipping for added protection or go with the more budget-friendly Ro/Ro (Roll-on/Roll-off) method, where vehicles are driven directly onto the ship.

8. Implementation Timeline, Grace Periods, and Enforcement

When it comes to the 2025 EV import regulations, the timeline and enforcement details are still up in the air. As of now, there’s no clear schedule, grace periods, or enforcement measures in place. This uncertainty means importers and dealers need to stay vigilant, keeping a close eye on updates from customs authorities and the Ministry of Transport. It’s crucial to ensure all documentation and vehicle specifications are fully prepared to avoid potential holdups at customs. Partnering with seasoned customs brokers or legal advisors can be a smart move to help navigate these unclear transitional phases.

Conclusion

As Burundi prepares to roll out its 2025 EV import regulations, these changes are set to reshape the country’s electric vehicle market. From adjustments in customs duties to updated documentation and registration processes, understanding these shifts is key for importers, dealers, and buyers aiming to navigate the new landscape effectively.

For businesses, compliance is essential – not just to avoid penalties but also to take advantage of government incentives designed to encourage EV adoption. The EV market in Burundi has already seen impressive growth, with double-digit increases in both production and sales. Experts anticipate this momentum will continue, driving further expansion in the automotive sector. Early adopters stand to benefit the most, leveraging incentives aimed at boosting EV use.

Importers should ensure they have all the required paperwork in order, including the original registration card, purchase invoice, and bill of lading with detailed vehicle information. Partnering with experienced customs brokers or legal advisors can help smooth the transition and address any regulatory hurdles.

For consumers, these regulations could mean better access to EVs, supported by government subsidies, and assurance that imported vehicles meet necessary safety and environmental standards. Keeping an eye on updates from customs authorities and the Ministry of Transport will be crucial to navigating this evolving framework.

"It highlights where EVs could deliver meaningful gains and build momentum for a pro-EV agenda, even in markets still early in readiness".

Ultimately, adapting to these reforms plays a role in shaping Burundi’s automotive future. Staying informed and prepared will be key as enforcement details emerge from customs authorities.

FAQs

What advantages do Burundi’s new EV import regulations offer to individual importers?

Burundi’s revised electric vehicle (EV) import rules for 2025 bring a host of perks for individual importers. These updates include lower import duties, simpler paperwork, and well-defined compliance standards, all aimed at making the import process easier and more affordable.

By cutting down costs and reducing customs hurdles, these changes are set to promote the adoption of EVs on a larger scale. On top of that, the updated technical and safety guidelines ensure that imported EVs meet required standards, providing importers with added assurance and a more predictable experience.

What issues might arise from not requiring inspections for imported EVs?

Without required inspections, imported electric vehicles (EVs) bring a set of potential risks. Hidden safety or mechanical issues might slip through unnoticed, potentially affecting the vehicle’s performance or dependability. This absence of oversight also raises concerns about meeting safety and environmental standards, which could result in legal challenges or delays in making these vehicles road-ready. For buyers, this could translate to unforeseen repair costs or lingering safety worries in the future.

How does Burundi’s vehicle age policy affect the cost of importing EVs?

Burundi has announced updated regulations permitting the import of electric vehicles (EVs) up to 10 years old, starting in 2025. This shift could help reduce import costs since older EVs are typically more budget-friendly than newer ones.

By extending the age limit, the policy opens the door for businesses and individuals to explore a broader selection of EVs, potentially boosting the adoption of electric vehicles across the country.