Congo has introduced new electric vehicle (EV) import regulations for 2025, aiming to modernize its automotive market while leveraging its cobalt resources. These rules include stricter emissions standards, age limits for used EVs, mandatory pre-shipment inspections, and changes to customs duties and VAT. Key updates also address battery safety, documentation requirements, and support for local manufacturing. Importers face higher costs but may benefit from potential exemptions for locally assembled EVs. Here’s what you need to know:

- Stricter Emissions Standards: EVs must meet lifecycle sustainability criteria, including manufacturing and recycling impacts.

- Age Restrictions: Used EVs must be under 10 years old; older vehicles face destruction or re-export.

- Pre-Shipment Inspections: EVs and batteries require certification from approved bodies like Cotecna or Bureau Veritas.

- Higher Import Costs: Importers face up to 30% customs duties, a 15% excise tax, and 18.9% VAT, among other fees.

- Battery Shipping Rules: Updated protocols include specific UN classifications and state-of-charge limits.

- Documentation: Additional certificates and inspections are required, with penalties for non-compliance.

- Cobalt Policy Links: New cobalt export quotas aim to encourage local battery production.

- Fast-Track Clearance: A streamlined process for compliant importers is under development.

These changes reflect Congo’s push to regulate EV imports, promote sustainability, and strengthen its position in the global EV supply chain. Importers must adapt to these rules to avoid penalties and delays.

1. Stricter Emissions and Environmental Standards for EV Imports

Starting in 2025, Congo will enforce new regulations requiring imported electric vehicles (EVs) to meet rigorous environmental criteria throughout their entire lifecycle. These rules go beyond simply eliminating tailpipe emissions. They take into account the broader environmental impact of EVs, including how they are manufactured and how their components are recycled at the end of their lifespan.

Although detailed instructions from regulators are still forthcoming, importers should stay alert to these developments. These regulations reflect a growing global push toward more sustainable practices, and businesses will need to adapt their operations to stay compliant.

2. Age and Usage Restrictions for Used EV Imports

Starting in 2025, Congo will enforce strict age limits on imported used electric vehicles (EVs). Passenger EVs – those with fewer than 10 seats – must be less than 10 years old. Buses with 10 or more seats are limited to 7 years, and electric lorries must also be under 10 years old. These rules are designed to ensure compliance and shape the market toward newer vehicles.

For importers, this means focusing on newer, and often more expensive, EV models. Vehicles that fail to meet these requirements face serious consequences: they’ll either be destroyed or re-exported at the owner’s expense. This risk makes it essential to confirm manufacturing dates through Vehicle Identification Numbers (VINs) and proper documentation. Additionally, used vehicles older than 15 years are subject to a 12% excise tax. While this tax primarily affects conventional vehicles, EVs that don’t meet the criteria won’t even make it past customs. Together, these measures limit affordable options, pushing the market toward higher-priced, compliant vehicles.

Next, let’s look at the pre-shipment inspections required for EVs and their batteries.

3. New Pre-Shipment Inspection Requirements for EVs and Batteries

Starting in December 2025, Congo is introducing stricter rules for importing electric vehicles (EVs) and batteries. Under these new regulations, all EVs and batteries must pass a PCEC pre-shipment inspection. The PCEC, established back in October 2021, now requires compliance checks for every shipment. This program is designed to ensure that imported EVs and batteries meet safety and quality standards, keeping unsafe or low-quality goods out of the country.

To meet these requirements, importers need to obtain a Certificate of Conformity from either Cotecna or Bureau Veritas – two authorized inspection bodies – before shipping their goods. Shipments without this certificate will be rejected by customs.

4. Changes to Customs Duties and VAT for Electric Vehicles

Congo’s 2025 Finance Law brings significant updates to the tax structure for importing electric vehicles (EVs). A notable change includes a 15% excise duty on motor vehicles and motorcycles, which now applies to EVs as well.

Importers face a complex tax landscape. EV imports are subject to customs duties of up to 30%, along with an 18.9% VAT (comprising an 18% base rate and a 5% surtax). On top of these, there are additional entry taxes calculated on the CIF (Cost, Insurance, and Freight) value, including:

- 1% CEMAC integration tax

- 0.2% African integration tax

- 0.2% statistical tax

- 0.05% OHADA tax

- 0.04% CEEAC tax

- 2% computer royalty

To put this into perspective, importing a vehicle with a CIF value of $30,000 results in substantial costs. Importers would face approximately $9,000 in customs duties (30%), $4,500 in excise duties (15%), and $5,670 in VAT and entry taxes. Altogether, the total tax burden could exceed $20,000, making the process financially challenging. This steep expense underscores the potential cost advantage of assembling EVs locally.

For locally assembled EVs, there’s an opportunity for savings. Input materials used in local production may qualify for an exemption from excise duty, provided the importer obtains a specific exemption certificate. However, this exemption does not extend to customs duties or VAT, which still apply.

5. Updated Documentation and Labeling Requirements for EVs

Congo’s 2025 regulations are set to bring tighter documentation rules for electric vehicles (EVs), following a similar path to recent cobalt export reforms. While the exact requirements for EV documentation are still being finalized, importers should brace for a more detailed verification process. Updates to labeling standards are also in the works, hinting at stricter enforcement measures on the horizon.

To comply, companies will need to prepay royalties, obtain compliance and quota certificates, and secure liberatory receipts before customs clearance. Additionally, physical inspections by multiple government agencies will become a standard part of the process.

Failure to meet these requirements could lead to serious consequences, such as license revocation and unpredictable delays in processing timelines.

Navigating these changes will require careful planning. Importers should focus on keeping detailed records, ensuring all necessary certificates are obtained before shipping, and collaborating with seasoned customs brokers to minimize disruptions.

sbb-itb-99e19e3

6. Enhanced Safety Rules for Shipping EV Batteries

Starting March 31, 2025, Congo’s updated EV import rules will introduce new safety protocols for shipping batteries. Under these changes, e-bikes and e-scooters will no longer use the UN 3171 classification. Instead, batteries will now fall under specific UN numbers: UN 3556 for lithium-ion, UN 3557 for lithium-metal, and UN 3558 for sodium-ion batteries. These updates also call for revised shipping documentation and more precise labeling, paving the way for adjustments to air freight protocols.

For air freight, the International Air Transport Association (IATA) recommends keeping the State of Charge (SoC) – the percentage of a battery’s current capacity compared to its maximum – at or below 30% for lithium-ion battery shipments. Starting January 1, 2026, this 30% limit will become mandatory for vehicles with batteries exceeding 100 watt-hours and for lithium-ion batteries in equipment packs over 2.7 watt-hours. Shipments exceeding these thresholds will require special approval.

To stay compliant, importers should consult the IATA Battery Shipping Regulations manual for 2026. This guide outlines updated rules for packaging, marking, and labeling to meet the new standards. Working with freight forwarders experienced in handling dangerous goods will also be essential for navigating these changes effectively.

7. Connection to Congo’s Cobalt and Battery Manufacturing Policy

Congo is taking bold steps to redefine its role in the global EV and battery supply chain. The country’s new rules for EV imports are just one piece of a larger plan aimed at transforming its approach to mineral exports. As the Democratic Republic of Congo (DRC) holds some of the world’s largest cobalt reserves, it’s introducing policies to ensure more of the wealth generated from this critical resource stays within its borders.

Starting October 16, 2025, the DRC rolled out a cobalt export quota system. This system is designed to regulate market access and stabilize prices for cobalt, a key material in battery production, especially after prices hit a nine-year low earlier that year. By limiting raw cobalt exports, the government is pushing for more domestic processing, which ties directly into their strategy to develop local battery manufacturing. This approach complements the country’s stricter EV import rules and positions Congo as a player in the higher-value stages of the battery supply chain.

The tighter import restrictions serve another purpose: they make it harder to bring in finished EVs and batteries, creating a stronger incentive for manufacturers to set up operations locally. Together, these policies aim to stimulate the growth of domestic industries while reducing reliance on raw material exports. For businesses operating in the region, staying on top of these evolving regulations is crucial, as they directly impact costs, compliance, and competition.

8. Fast-Track Clearance Process for Compliant Importers

As of now, Congo’s 2025 EV import regulations do not include detailed information about a fast-track clearance process for compliant importers. Key aspects such as eligibility requirements, processing timelines, and specific advantages remain undefined. Importers are encouraged to stay alert for updates from official channels as the framework continues to take shape. This upcoming fast-track system underscores Congo’s commitment to improving and simplifying its EV import procedures.

Comparison Table

Congo EV Import Rules 2025: Previous vs New Regulations Comparison

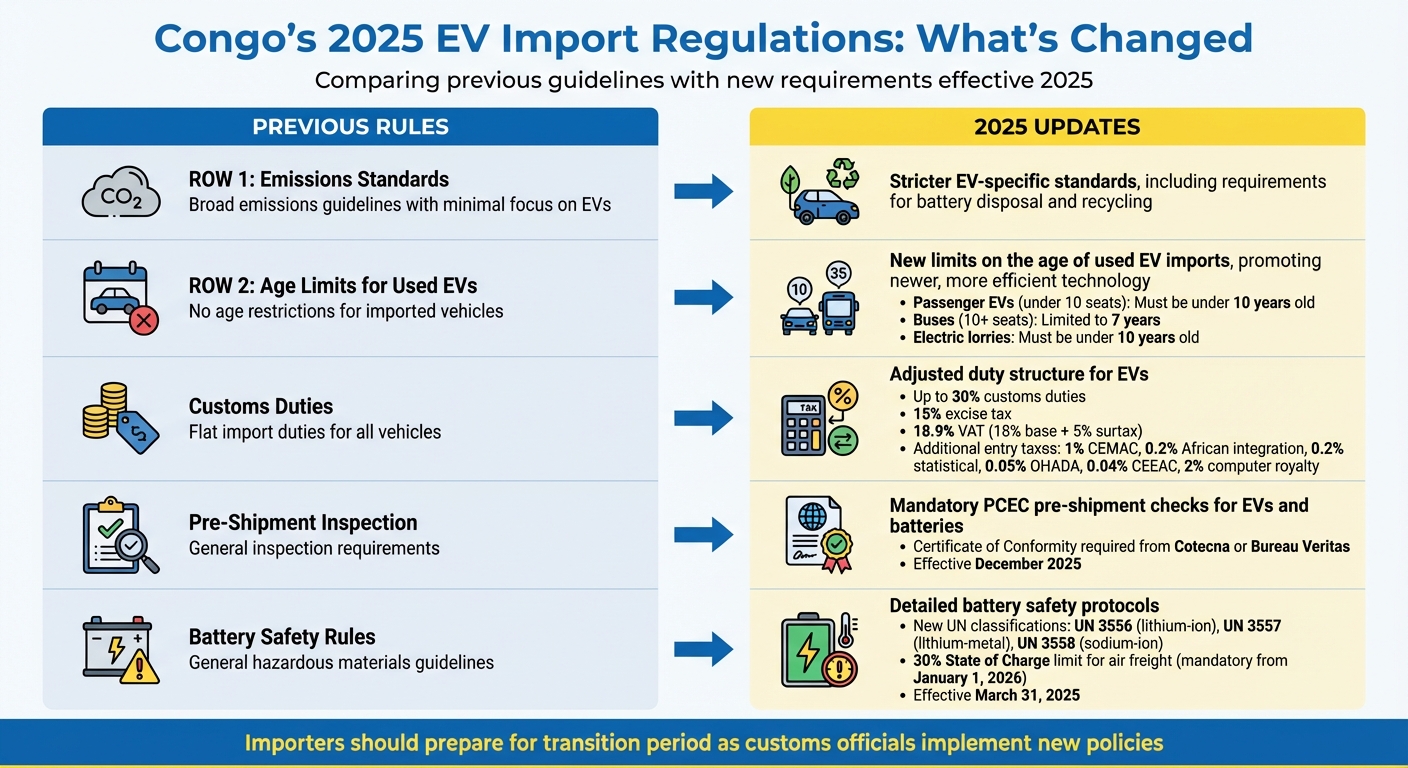

Congo’s 2025 EV regulations bring significant changes to the vehicle import process, replacing the previous framework with updated rules tailored to electric vehicles (EVs). These adjustments are key for EV importers navigating the new landscape.

The table below highlights the main differences between the old regulations and the 2025 updates:

| Category | Previous Rules | 2025 Updates |

|---|---|---|

| Emissions Standards | Broad emissions guidelines with minimal focus on EVs | Stricter EV-specific standards, including requirements for battery disposal and recycling |

| Age Limits for Used EVs | No age restrictions for imported vehicles | New limits on the age of used EV imports, promoting newer, more efficient technology |

| Customs Duties | Flat import duties for all vehicles | Adjusted duty structure for EVs, with potential incentives for importers meeting compliance standards |

| Pre-Shipment Inspection | General inspection requirements | Mandatory pre-shipment checks for EVs and batteries to ensure safety and adherence to regulations |

| Battery Safety Rules | General hazardous materials guidelines | Detailed battery safety protocols, covering shipping, handling, and enhanced safety measures |

Importers should be prepared for a transition period, as customs officials implement these new policies. This may involve additional administrative processes to ensure smooth compliance with the updated framework.

Conclusion

Congo’s updated regulations for electric vehicle (EV) imports, set to take effect in 2025, signal a major transformation in how EVs enter the country. These eight regulatory changes – ranging from stricter emissions standards to expedited customs procedures – present both hurdles and opportunities for importers across Africa. This section connects the earlier details to their broader implications for the market.

For importers, adapting quickly will be critical. The new rules build on previous regulatory shifts, demanding a more precise and proactive approach to the import process. Those who familiarize themselves with these updates now can avoid unnecessary delays and steep penalties down the line.

Adding to the complexity, recent changes to Congo’s cobalt export policies highlight the importance of careful supply chain management. With rising costs for essential battery materials, businesses must adopt thorough due diligence practices and explore strategic partnerships to optimize sourcing. This reflects Congo’s growing focus on leveraging its resources, as discussed earlier.

To navigate these changes effectively, importers should work closely with ANAPI to handle administrative requirements and stay informed about reforms outlined in the government’s Strategic Business Climate Plan. Additionally, Congo’s focus on ethical cobalt sourcing underscores the need for compliance with international standards, further tightening the supply chain.

As the regulatory environment continues to shift throughout 2025, businesses that prioritize compliance and strategic planning will position themselves to thrive in Congo’s expanding EV market. These developments underscore Congo’s emerging role in shaping the future of sustainable transportation across Africa.

FAQs

What are the updated age limits for importing used electric vehicles into Congo starting in 2025?

The specifics regarding age restrictions for importing used electric vehicles (EVs) into Congo in 2025 remain unclear based on the available information.

To ensure you have the most accurate and up-to-date details, it’s best to refer to Congo’s official regulations or contact local authorities responsible for EV import policies.

How will the new customs duties and VAT exemptions affect the cost of importing EVs into Congo in 2025?

Starting in 2025, fully electric vehicles (EVs) brought into Congo will no longer be subject to customs duties or value-added tax (VAT). This policy shift is set to lower the cost of importing EVs, potentially making them more affordable for both consumers and businesses.

By removing these fees, Congo is taking steps to promote the use of EVs, advance eco-friendly transportation, and boost the local EV market. For importers and investors, this change means reduced initial expenses, which could translate to more competitive EV pricing across the region.

How do Congo’s new cobalt export quotas affect local battery production?

Congo’s newly introduced cobalt export quotas are set to reshape the industry by prioritizing domestic battery production. The goal is clear: process more raw materials within the country to strengthen local manufacturing, create jobs, and reduce the dependence on exporting unprocessed cobalt.

For businesses and investors, this policy shift opens doors to opportunities in Congo’s expanding battery production sector. However, it also brings potential challenges, such as tighter regulations and necessary adjustments in supply chains for companies relying on cobalt imports. Staying informed about these changes is essential for navigating the rapidly evolving electric vehicle market.